Calculate my equity

Home spent between 65 and 93 days on the market from listing to. In 2018 the typical US.

:max_bytes(150000):strip_icc():gifv()/equity_final-da21918a6af144f39c6cd36c22397437.jpg)

Equity For Shareholders How It Works And How To Calculate It

So if your home is worth 500000 and you still owe 200000 on your.

:max_bytes(150000):strip_icc():gifv()/debtequityratio_final-18c02abef4f74c1591dc9b12be962b1b.jpg)

. During your 10-year draw period you can borrow as little or as much as you need up to your approved credit line. This means your usable equity would be calculated as 640000 80 property value minus 440000 loan size 200000. Using the earlier example youd need to have 100000.

Learn from Better Money Habits how to calculate your loan-to-value ratio before refinancing with a home equity loan or line of credit. In this case your equity in this example would be 120000. To calculate the debt-to-equity ratio.

Movie News How Dont Worry Darling Drama Kept Burning After Venice Premiere Despite an enthusiastic reception and a seven-minute standing ovation the online frenzy surrounding the film. To calculate interest rate start by multiplying your principal which is the amount of money before interest by the time period involved weeks months years etc. Alternatively it can be derived by starting with the companys.

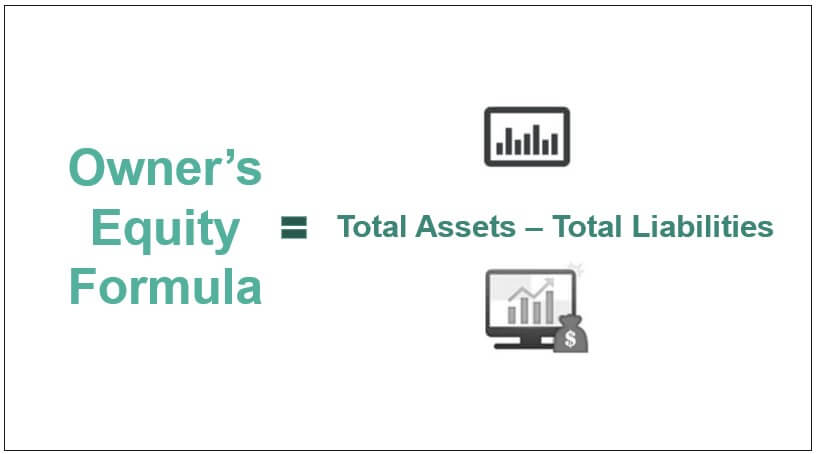

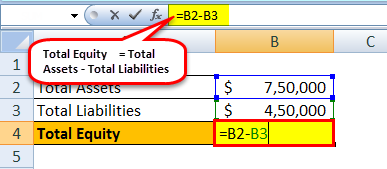

A home equity line of credit or HELOC allows you to borrow against the equity of your home at a low cost. Using the debt-to-equity ratio formula divide your companys total liabilities by its total shareholder equity to find your debt-to-equity ratio. Shareholders equity may be calculated by subtracting its total liabilities from its total assetsboth of which are itemized on a companys balance sheet.

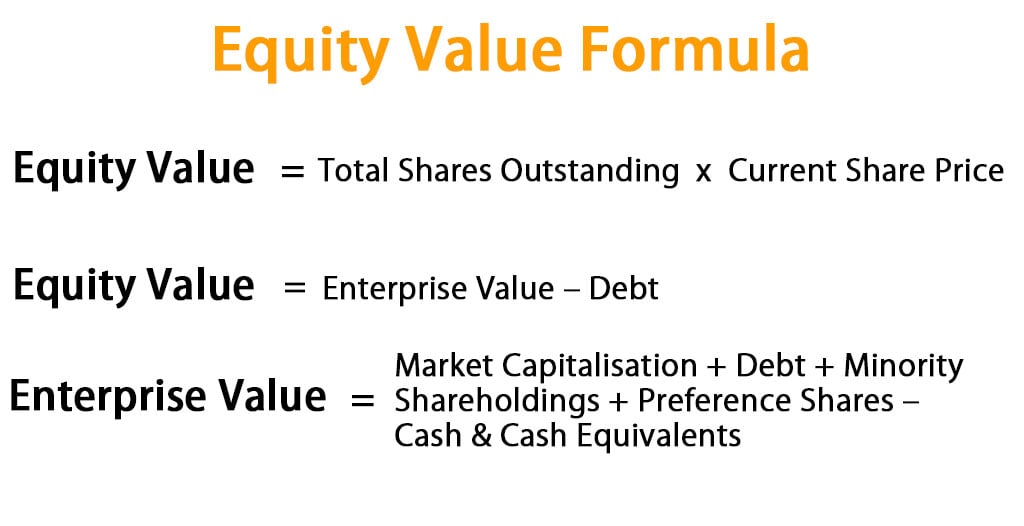

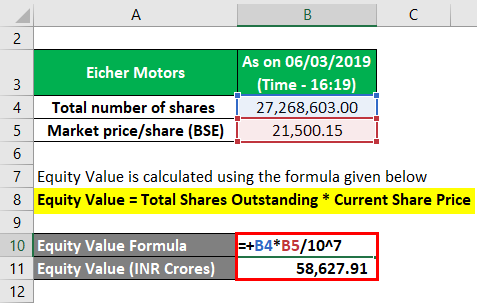

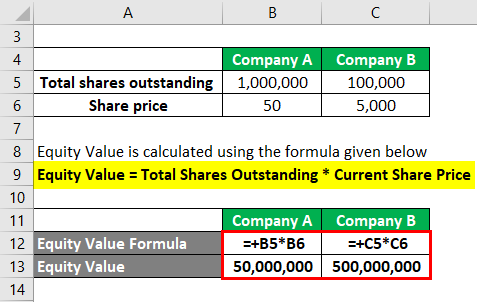

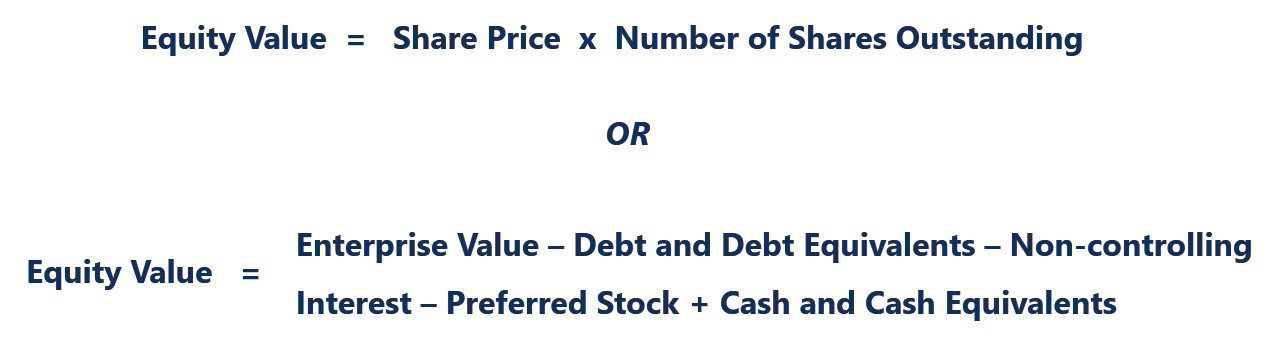

Understanding your home equity and how to calculate it is important to homeowners. Equity value commonly referred to as the market value of equity or market capitalization can be defined as the total value of the company that is attributable to equity investorsIt is calculated by multiplying a companys share price by its number of shares outstanding. The answer is your interest rate but it will be in decimal format.

The word per cent means per 100It is represented by the symbol. With a house buyout you have two main options. The value of the owners equity is increased when the owner or owners in the case of a partnership increase the amount of their capital contribution.

Return on equity is a measure that analysts use to determine how effectively a company uses equity to generate a profit. In this case the home equity percentage is 22 55000 250000 22. Your lender will calculate 80 of the value of the property 80 of 800000 is 640000.

Using the formula above consider a company with total liabilities equal to 5000. Unlike a mortgage or home loan its a flexible line of. The average time between a home going under contract and closing is 45 days but that doesnt include the time it takes before you receive and accept an offer.

W e weight of equity. If we have to calculate percent of a number divide the number by the whole and multiply by 100. Calculate how much you can borrow from your home using a Home Equity Line of Credit HELOC.

Once you know how much equity you have in your home you can determine if its sensible to borrow. Their total shareholders equity is 2000. It is shown as the part.

Even when you have equity in your home you probably wont be able to borrow all of it. Caveats of Return on Equity. Examples of percentages are.

Thank you for reading CFIs guide on Required Rate of Return. Hence the percentage means a part per hundred. Book Value of Equity Formula.

Calculating LTV and CLTV ratio. Home equity line of credit HELOC calculator. Paying the remaining balance and equity in full in cash or refinancing your mortgage and using the equity to buy out your ex-spouse.

Therefore the value of Jakes worth in the company is 11 million. How to Calculate Shareholders Equity. It is an online tool to calculate the minimum money or margin required to trade Equity Spot like INFY ACC WIPRO TVSMOTOR etc.

You can also divide home equity by the market value to determine your home equity percentage. How long does it take to free up my equity when selling. All home equity calculators.

10 is equal to 110 fraction. You have the option to choose a minimum monthly payment of 1 or 2 of your outstanding balance though some may qualify to make interest-only. While debt financing can be used to boost ROE it is important to keep in mind that overleveraging has a negative impact in the form of high interest payments and increased risk of defaultThe market may demand a higher cost of equity putting pressure on the firms valuationWhile debt typically carries a lower cost than equity and offers.

What is Equity Value. Calculate and then add together the shareholders equity figures from the beginning SE1 and the end SE2 of a companys year see Step 1 and divide this number by 2. It is calculated by adding the owners capital contribution treasury shares retained earnings Retained Earnings Retained Earnings are defined as the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company.

Write that number down then divide the amount of paid interest from that month or year by that number. You can buy your exs share of the equity straight out if you have enough cash on hand. How to calculate home equity.

How to calculate home equity To help reckon how much equity you have you can provide an estimate of your homes current value or get Read More a working estimate of how much your home is worth based upon whats happened to home prices in your market over time. In other words it measures the. Net income is the total revenue minus expenses and taxes that a company generates during a specific period.

A home equity line of credit is the most flexible type of home financing available. Line of credit calculator. Given most banks will likely lend you no more than 80 of your homes current value heres how to calculate your homes usable equity.

Jakes Equity 32 million 21 million 11 million. For example say your home is valued at 800000 and you have a home loan of 440000. In mathematics a percentage is a number or ratio that can be expressed as a fraction of 100.

Therefore the WACC can be viewed as a break-even return that determines the profitability of a project or an investment decision. Check HELOC rates from top Canadian banks. Home equity loan and HELOC guide.

It is obtained by taking the net income of the business divided by the shareholders equity. The amount of your outstanding loans 200000 Your homes potential useable equity 400000 200000 200000. Total assets to the amount of equity.

How Owners Equity Gets Into and Out of a Business. The WACC determines the overall cost of the companys financing. The calculator represents margin requirements for orders like Carry forward NRML Intraday order without stop loss MIS and Intraday order with Stop loss BO CO for Trade Pro and Freedom 15 Plan at a single glance.

This enables an investor to measure the change in profitability over a one year time period. Calculating the equity multiplier The equity multiplier on the other hand relates the size of the balance sheet ie. Return on Equity.

R e cost of equity.

Equity Value Formula Calculator Excel Template

Owner S Equity Definition Formula Examples Calculations

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Equity Formula Definition How To Calculate Total Equity

Equity Value Formula Calculator Excel Template

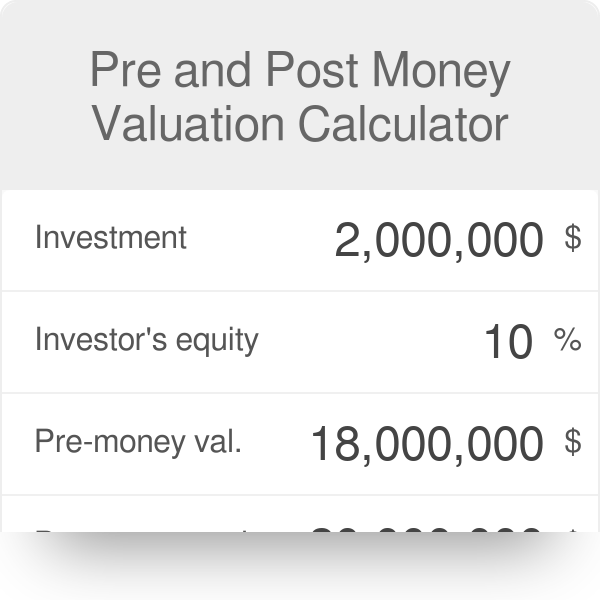

Startup Valuation Calculator Investment Equity Post And Pre Money

/returnonequity-v1-1cd72f9606e54be085ea56eb866cc9c4.png)

Return On Equity Roe Calculation And What It Means

Home Equity Calculator Free Home Equity Loan Calculator For Excel

How Do You Calculate The Debt To Equity Ratio

Equity Formula Definition How To Calculate Total Equity

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Loan Calculator Nerdwallet

Equity Value Formula Calculator Excel Template

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Equity Value How To Calculate The Equity Value For A Firm

:max_bytes(150000):strip_icc():gifv()/debtequityratio_final-18c02abef4f74c1591dc9b12be962b1b.jpg)

Debt To Equity D E Ratio Formula And How To Interpret It

Home Equity Calculator Free Home Equity Loan Calculator For Excel